Enact Home is an independent solar monitoring solution that helps homeowners realize savings and track system health over the 25-year solar ownership journey. I joined Enact in 2022 to lead consumer products. Over ~2 years I built and led a cross-functional growth team of 8, achieving the following YoY results:

- User Growth: +878%

- Activation Rate: 50% | Monthly Active Users: +210%

- Visitors: +620% | Events: +876% | Time Spent: +853%

- Revenue Growth: +169%

- Referrals: +567% | 7% adoption rate

Context

Q1 2022: Product Vision, Competition, User Research

Problem: Beta version of monitoring developed by remote engineers as a “proof of concept” – UX and features were limited, value props unclear and usage unknown. My first task was to gather data to inform product vision:

- Assess market size: end user monitoring US TAM = 3 million | California SOM = 300k

- Evaluate competition: SWOT analysis of existing solutions (sensors, installers, OEM)

- Gather data: 24 customer interviews + first statewide survey of 482 California solar homeowners

Q2 2022: Define Value Props, Identify and Deliver Early Wins

I defined 3 value props based on a) user needs, b) gaps in existing solutions, and c) strategy to enable growth via differentiated value:

- Validate value props: 1:1 sessions with existing users

- Launch “willingness to pay” survey: with new users / prospective buyers

- MVP feature development: quickly develop working code for low-effort and low-risk features by leveraging existing FT and contract resources

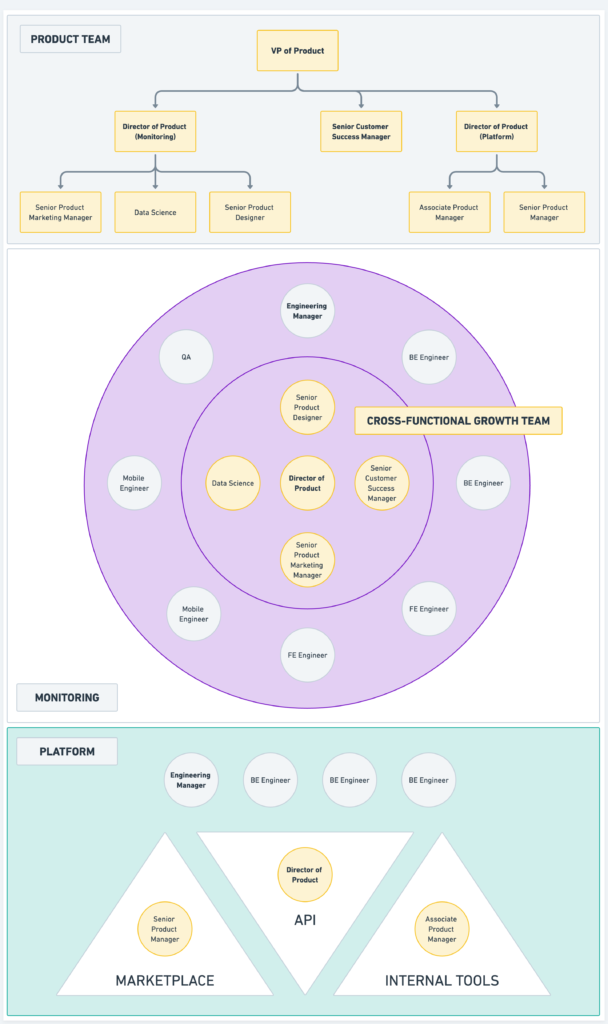

Q3 2022: Build Product and Cross-Functional Teams, Measure Growth

In Q3 I began assembling a dedicated team and using product design + development best practices to overhaul core features and experience:

- Built cross-functional team for product-led growth: develop features via collaboration between PM, UX, Data Science, PMM, CS, Marketing and Sales

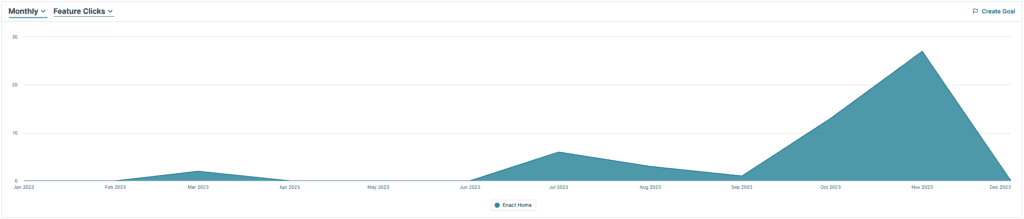

- Implement Build / Measure / Learn: launch tightly scoped MVP features, use behavioral analytics to measure engagement across user segments (Pendo, LogRocket and LaunchDarkly)

By Q4 the initial overhaul was developed, tested and released. The team drove ahead, revising web app, mobile app and a white label version for channel partners.

Results: Q1-Q4 2023

Using Dave McClure’s AARRR “Pirate Metrics”

Acquisition

User Growth: +878% YoY

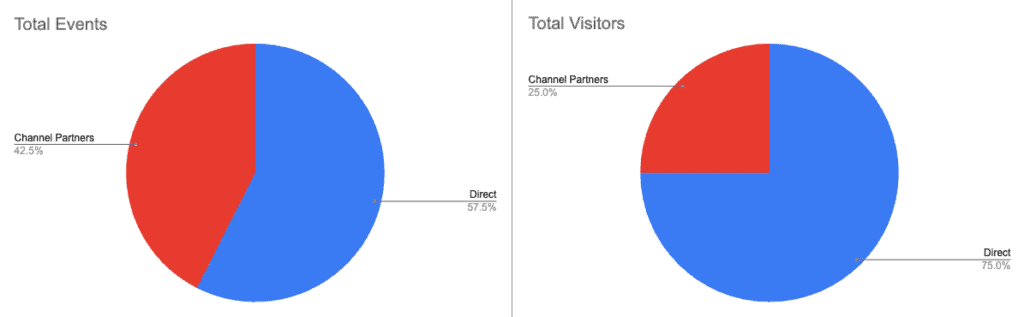

Developed a two-pronged approach for growing user base working with Sales and Business Development, resulting in 2X increase via direct sales and 9X increase via channel partners. Core audience (direct sales) was most engaged, representing 75% of visits and 58% of total events.

- Direct Sales: + 94% YoY

- Channel Partners: +785% YoY

Activation

Activation Rate: 50% | Monthly Active Users +210% YoY

Once user experience and core value props were stabilized, a series of “win back” campaigns helped drive activation. Half of core audience logged in at least one time in 2023. Number of monthly active users increased 3X from January to December.

Activation metrics improved via: a) cross-functional collaboration and b) feature design using product-led growth principles.

Increase in MAUs a result of:

- Improved coordination with Sales and Customer Success for onboarding new users, including revised and automated internal processes to ensure data quality for a positive initial experience.

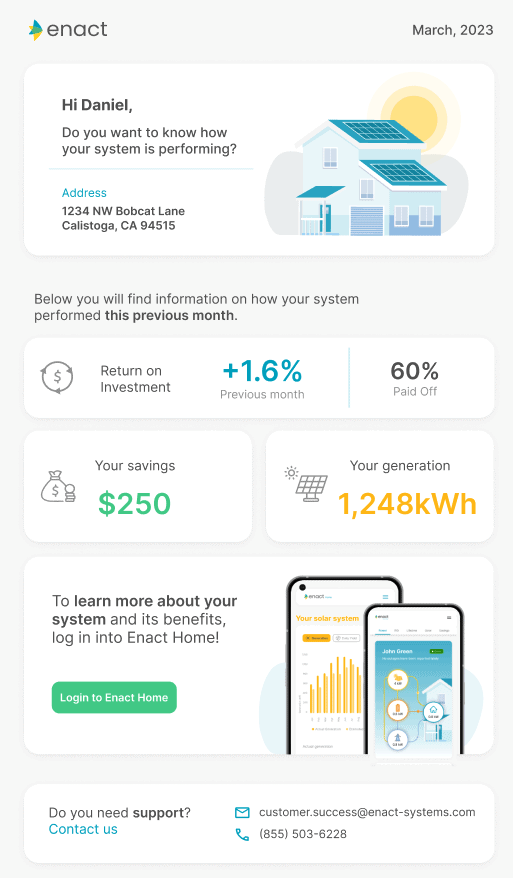

- Established Product Marketing function to a) own feature roll-out, b) launch email campaigns to win back dormant users and c) deepen engagement of existing users.

- Launch of Monthly Report, which provides users the option to receive an automated email summarizing ROI, savings and generation. For more details, users are provided a link to their account.

Retention

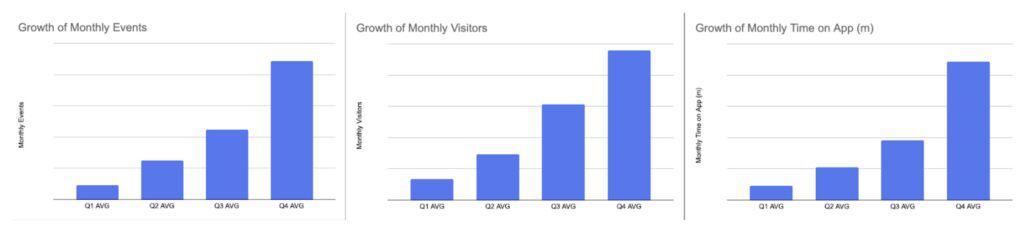

Visitors: +620% | Events: +876% | Time Spent: +853% (All YoY)

Strong growth achieved across three major engagement metrics: 1) number of visitors, 2) event volume and 3) time spent in-app. Significant and sustained increase in retention QoQ interpreted as signal of product/market fit with the core audience in terms of feature and value props.

Average QoQ growth rates:

- Monthly events: 117%

- Monthly visitors: 95%

- Monthly time on app: 113%

Revenue

Revenue Growth: +169% YoY

Developed revenue model and 5-year revenue plan based on monetization methods including: freemium, subscription, referrals, premium support and setup fee. Modeled how “top 5” revenue generating features would change over time, as user base grows 5X, 10X and 25X. 5X target set as 2024 OKR.

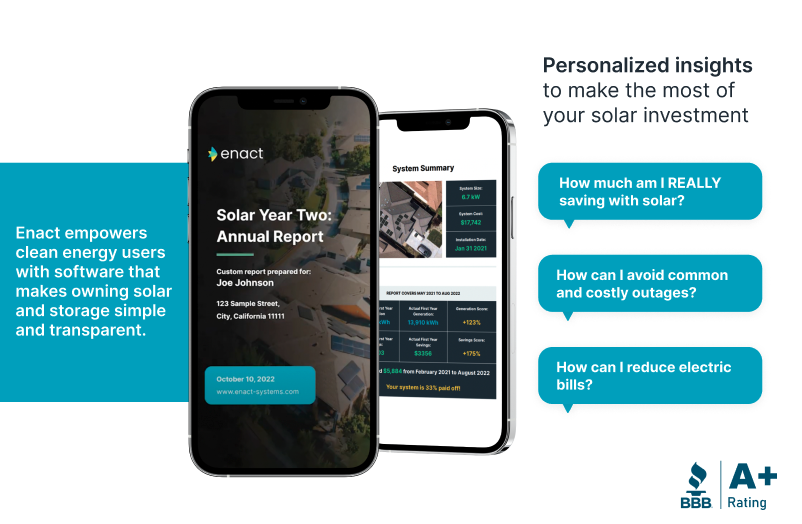

Developed first of its kind program that allows “micro producers” to receive quarterly payments for Renewable Energy Certificates (RECs). California solar homeowners owners can earn $125+ per year for the clean energy they are already producing. Built services to automate eligibility verification and registration. Created financial model that assessed initial business potential for aggregation of voluntary RECS via residential and commercial systems in California as $2m ARR with 3X growth over 7 years. Voluntary REC market in the US projected to grow from “$1.9 billion in 2023 to $6.4 billion by 2030.”

Referrals

+567% YoY | 7% adoption rate

Launched multi-channel solution to automate referrals (in-app, email and SMS). Users earn $250 for each referral and can refer friends and family outside of a single installer’s local service area, using Enact’s independent and trusted nation-wide installation program.

Identified “super fans” who made 2.3X and 6.1X more referrals than average.

Value Props vs Features

1) Track solar savings: most users purchase solar to realize promised savings, but existing monitoring applications report data in “kilowatt-hours”. Users expressed enthusiasm for a savings-centric monitoring solution that translated electricity generation into “dollars saved”.

Savings features:

- Percentage paid off: track ROI

- Connect utility: to view electricity bills, imports and exports

- Option to apply federal tax credit to reduce system cost

2) Manage system health: home owners participating in our state-wide survey reported 54% of systems needed maintenance. Published industry data indicates a 35% failure rate for inverters over 15 years, but installers and manufacturers agree off the record that rates are higher. Users were unaware that outages are common and costly, often lasting 3-6 months with out-of-pocket costs in the hundreds of dollars.

System health features:

- Estimated vs actual: compare generation to our software model

- Offline alert: get notified in-app and via email if system stops reporting

- Notify installer: in case of unresolved outage lasting 72h, send installer a detailed outage report

3) Earn money from solar: we provide the opportunity to experience “fringe benefits” of solar ownership — allowing cleantech assets to generate annual cashflows.

Monetization features:

- Referrals: earn $250 for each qualifying referral

- RECS: California solar owners can earn $125 every year for the clean energy they are already producing

Thanks for reading! Any questions, feel free to email.